CAP Funding – Complete Steps

Developers can secure advantageous capital via CAP for US$25 million or more using these steps, from inception to done

What is a “Completion Assurance” guarantee and why does In3 CAP require one?

Follow steps 1-6, Inception to Due Diligence, to apply for funding. These steps mirror the CAP funding’s Six Essentials to pre-qualify and launch our rapid due diligence, expediting first draw of funding within 30-45 days max. More on CAP funding’s main purpose and advantages. Or, for experienced developers of mid-market projects, four notorious problems CAP funding solves as well as when CAP is the best or only option for funding through us.

NEW for 2022! Instructions for developers to pre-qualify for funding, including helpful tips for securing the guarantee instrument, Step 3, below: Download PDF

- Check to ensure the project size and industry are a fit (per In3’s sweet spot) and identify the project name, industry sector, and total funding requested.

Tip 1: Developers working with an In3 Affiliate can ask their advisor if their project fits with In3’s funding mandate. If you are not yet represented, refer to these 4 “S” cornerstones to make certain your project is able to qualify.

Tip 2: Synopsis of what it takes to secure CAP funding: here (1-page cover letter). Funding request must be US$25 million or more ($35M+ preferred), where funding can be in the local currency, at these indicative terms, with the first 4 of 6 “Essentials” shown here used to determine funding feasibility. This ensures that no time is wasted.

The goal is to pre-qualify via the steps outlined below, to move forward with investor Due Diligence and, if all is in order, make a binding offer to fund the project(s).

Result: Identify the project or portfolio NAME and total BUDGET (in $ or €) as well as the funding requested.

You may also want to use this basic information to register in our tracking database. Although not required, registration will enable you record the developer’s basic profile, contact information, project name/location, project industry sector, total project budget, and total required In3 funding. When you register, indicate whether the project is new construction or retrofit, and (if known) the preferred type of guarantee to be used. Options Guide by type.

We will acknowledge receipt and, if aligned, express an interest in proceeding. - Uses of Funds — document project cost categories and amounts / %’s for each category. See our Guide to Creating a Uses Statement (4-page PDF) with several examples on pgs 3-4.

Result: We acknowledge receipt and whether to proceed. If you send us a separate email with the target guarantee face value amount (in US$ or Euros), and project (unlevered) IRR, we can usually offer preliminary terms. Binding terms available once we complete our due diligence, Step 7.

NOTE: We usually don’t charge an application fee, so you literally have nothing to lose. - Propose Financial Guarantee type and Instrument Verbiage: Developer asks their bank or the sponsor’s bank to propose the verbiage for the guarantee instrument (Bank Guarantee/SbLC, Bank-endorsed Promissory Note or Sovereign Guarantee; all templates available here or below).

Note that just an unsigned draft of the instrument is to be requested from the involved bank. This can be sent as a standalone Word or PDF document via Email for our bank’s review and approval. We also ask for the name of the involved bank’s branch location and the officer name(s) that agree to provide the proposed guarantee or bank’s Aval. NEW! See INSTRUCTIONS and tips for this step: Download PDF

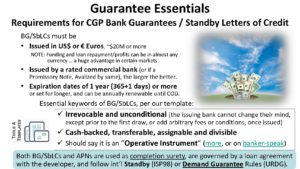

Result: We will review and offer either feedback or approval of the proposed Uses of Funds and instrument verbiage. Note: An Expression of Interest (EOI) can be arranged at this point upon request. Click on the image for BG/SbLC “essentials” as a guideline for those requirements or download appropriate templates to be relayed to the banker you or the sponsor will ask.

WARNING: Bankers often misread this request when they are unfamiliar with this program’s innovations. There are some subtle but important differences to standard (mainstream) practices. Read Communicating with bankers about the guarantee. - Propose the monthly draw schedule using relatively consistent monthly amounts, or increasing amounts (the funding bank will not approve a “whoosh” of large initial draws). Sample draw schedule on page 3

Result: The funding bank approves based on the acceptability of the instrument’s verbiage, stated uses of funds and monthly draw schedule. - Request RWA letter from issuing bank. We will offer the name/location of the funding bank (the project’s package, Step 6, to be delivered to In3 within 2 weeks) for the issuing bank to provide an RWA letter sent via Email or SWIFT MT799. RWAs are like a bank’s Letter of Intent (all templates available here). We may also ask for an Authorization to Verify (ATV) letter from the client that enables the funding partner to contact the issuing banker(s) by Email to confirm their RWA status.

Result: Acceptance of the RWA letter or equivalent confirmation of the bank’s intent to provide the instrument when the time comes — once all the funding-related contracts are in place. - Developer provides the balance of the package, including a project summary, financial summary and all related documents and disclosures needed for Due Diligence. A dataroom can be used if files are numerous and/or large.

Result: Project pre-qualifies for In3 advantageous CAP funding. In3 acknowledges receipt of the complete file or requests further information until the project can enter streamlined Due Diligence.

Remaining steps carried out by In3 Capital Partner with final terms memorialized via a Loan Agreement and Share Purchase or Subscription Agreement - Due Diligence to Offer: We conduct formal due diligence – typically lasting just 2-3 weeks. We are less stringent than most project financiers, but still like to see reasonably low or no commercial risk (such as long-term supply/offtake agreements), pro forma projections with transparent assumptions using standard accounting practices, detailed site description, developer profile, remaining pre-construction steps, if any, and all disclosure documents organized and easily located. For more on our diligence process, see this Financeability Checklist.

Result: If all goes well, a binding offer for the loan (a Loan Agreement) plus an equity carried interest (via a Share Purchase Agreement). - All contracts are entered to reach closing, including the sell-side (developer’s agreements with service and capital providers) plus any side agreements, developer establishes SPV, etc. Then the guarantee instrument is delivered (see the more detailed protocol, “Guarantee Instrument Delivery to Capital Draws” phase here).

Result: Financial closing happens quickly upon receipt of the hardcopy instrument at our bank. - Fund & Launch: Funding flows per draw schedule … until Commercial Operation Date (COD). Capital resources are used as stated in Step 3. Because project is completely funded, vendors are reliably paid on time. Guarantee is renewed as needed so that monthly drawdowns continue; parties work together to resolve issues until project completion and commissioning.

Results: Any unforeseen circumstances raised and addressed in a cooperative manner. Project reaches COD, with any subsequent projects funded through the same finance facility also completed/commissioned; BG/SbLC or AvPN guarantee is allowed to expire and is removed on its maturity date.

Help & Instructions

| Downloadable Templates | Learn about guarantees | How to get it done |

|

Download, fill in and email relevant template to sponsor or sponsor’s bank:

|

Decision-making guide to select the right type of guarantee for your situation Additional topics: |

A. Developer facilitates their own guarantee and asks their bank for the draft (use template) B) If the developer lacks financial depth, seek a sponsor or backer yourself (see guide) C) Developer can also hire In3 to facilitate the required guarantee (learn more) |

| All guarantee and bank letter templates (proposal builder) | 1-page Overview for (third party) Guarantors | 3-page “how to get sponsors on board” |

Why use a guarantee at all? | Technical Protocol for bankers “Inception to Completion” with guarantee delivery and closing procedure included (1-page PDF)