Project Development Services

If your project is not yet entirely ready to begin construction, we have you covered.

Since 2002, In3 has completed clean energy, smart agriculture and food-related, waste conversion (especially biomass, tires and plastics, sometimes in collaboration with Carbon Drawdown Solutions), electric power generation-related (hydro, geothermal), renewable fuels, transportation, charging infrastructure, real estate, healthcare and other diverse project development consulting engagements. In most cases, we also financed the same projects we’ve helped to develop, offering a more coordinated approach than if you hired multiple firms separately.

More recently, we have provided “strategic advisory” to access our in-house capital, provided by a US family office (synopsis of our funding program), via introducing sponsors, technical service providers (owner’s engineering, for example), assisting with vendor selection, and performing financial audits of project pro forma projections.

We usually carry out this work under a Management Services Agreement after collaborating with the client to determine precise scope, timeframes and deliverables. All but a modest deposit or fixed-fee payment (based on milestones reached) can be deferred until after the project’s funding has been secured; these arrangements are open to discussion. We believe in the fairness of “shared risk, shared rewards.”

We do this work by consulting and advising developers, offering a comprehensive suite of services to owners and sponsors, from design/engineering, procurement, project planning, EPC firm selection, EPCM/project management, construction management and more, with success in specialized fields that emphasize strong financial fundamentals and industry best practices for moving through the phases of development — from inception to feasibility to financing to launch of the operating assets.

We offer highly competitive rates for accomplishing the following

- Site selection (ask us if you are unfamiliar with what this entails)

- Securing feedstocks or other long-term commitments

- Financial modeling (target is to articulate the various Uses of Funds, monthly draw schedule, underlying assumptions and overall IRR alongside other ratios); we bring a proven, IFRS-compliant template that helps streamline and accelerate pinpointing these fundamentals while also maintaining top quality. In3 is certified in this work by Moody’s Analytics (Oct 2012). Sample of Sources & Uses statement and monthly cashflow requirements (draw schedule)

- Technical team sourcing (EPC or general contractor) — strategy, contractual arrangements, business negotiation, and vendor selection

- Owner’s engineering / representation or architectural services — across solar, wind, WTE, geothermal, waste conversion, agriculture, food processing and real estate.

- Negotiating offtake agreements, drafting and/or facilitating PPAs or other commercial contracts

- Regulatory: Dealing with the regulatory agencies, feasibility studies, assessments, surveys and permits

- Building the project plan and full suite of documentation, including pro forma financial summary (per IFRS – international accounting standards) and financing proposal via an investor-grade package of materials

- Funding strategy — including whether or not to use our Capital Guarantee Program™ (more)

- Sourcing capital to reach mutual terms to construct and operate the project without giving up control, and without giving up more ownership or cashflow rights than necessary.

We specialize in large commercial- and utility-scale projects in developed and developing countries with experience in more than 40 countries to date. At present, utility-scale solar development (with storage) and direct investment are strongly integrated. More.

Discover how a capital guarantee can expedite financing.

For reliable financing at the best possible rates consider either

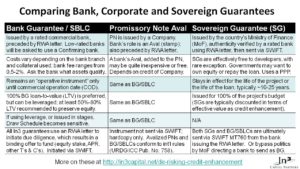

- Bank Guarantees, either directly (posting a BG or Standby Letter of Credit) or via sponsorship, such as from a well-established construction firm — more — or,

- Avalized Promissory Note (APN) — a company issues a simple PN using the same banking rules as a BG, but where the bank’s role is limited to an “aval” — more — or,

- Sovereign Guarantee, if you work in a country that offers an SG as part of public/private cooperation, more here.

What’s the difference between a BG/SBLC, APN, and SG in practical terms? more or click the image at right to view

Visit our resource center for related tools, including indicative financing terms.

Otherwise, without a capital guarantee, get started with financing your renewable energy project using our fast and easy Readiness Assessment (RAIN), and we will respond right away with initial feedback or questions, usually within 48 hours, but at the outset of 2021, perhaps due to the COVID pandemic, it may take us as much as 2 weeks to properly engage and offer feedback. Thanks in advance for your patience!

Meanwhile, please familiarize yourself with our 3-stage model:

Three-Phases to Funding Success

Our 3-stage process per our Capital Guaranteed Program (1 page PDF encapsulation) to expedite advantageous funding for mid-market projects:

- Screening and pre-qualification – In3 & partners assess if the project(s) are investable – basis: quality of loan guarantee(s), rating of issuing bank, financial fundamentals, risk profile, principals & ownership.

- Our due diligence — takes no more than 30 days, once the file is pre-qualified and approved per above.

- Launch & Fund — enter funding contracts, deliver guarantee instrument, and begin monthly draws. Proceed until project completion and commissioning, at which time the operative BG/SBLC would normally be allowed to expire.

CGP Screening & Pre-Qualification worksheet (2-pg PDF download) then visit our CGP Profile Builder (dataroom of all templates) for further resources.