Flagship CAP funding pairs well with senior loans

Hybrid funding offers best-of-both — non-dilutive private debt and equity

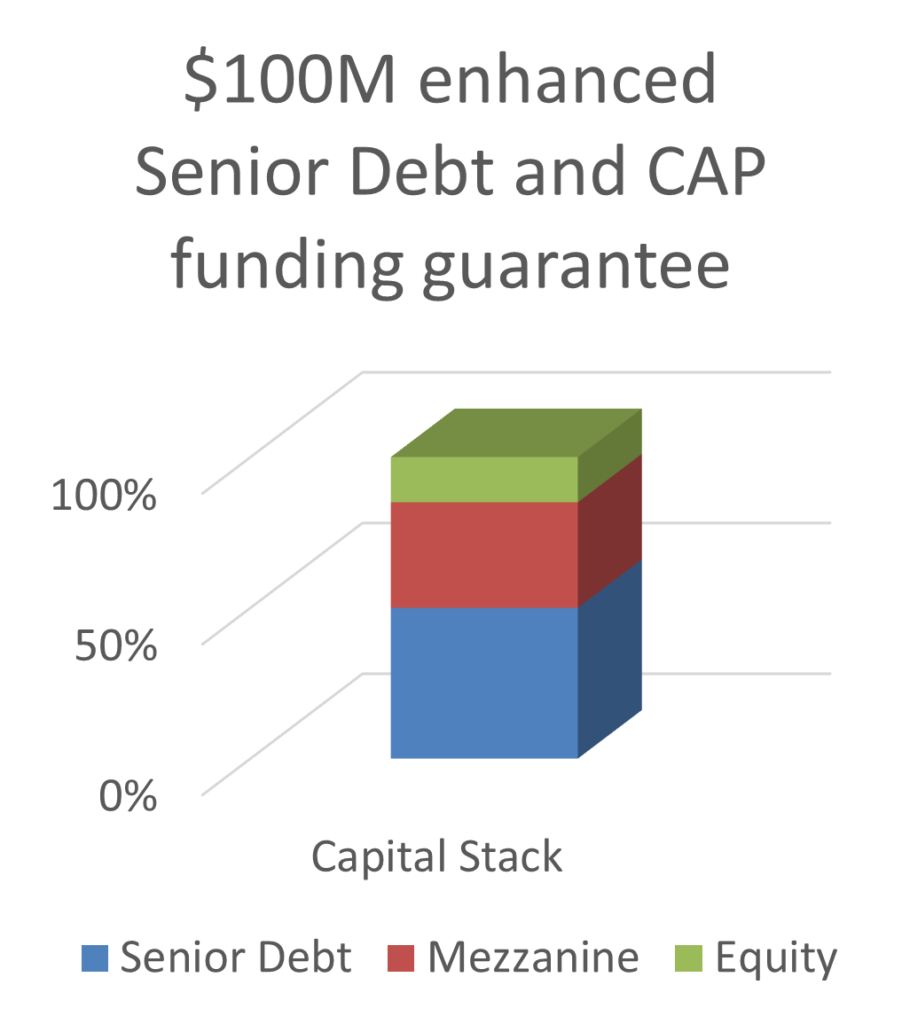

Combining the best of both project finance asset classes — senior debt and mezzanine/equity carried interest — greatly increases the odds of reaching closing, at better terms, and at a lower risk profile than debt alone. In3 offers 100% financing via specialized services that work with two or more in-house sources side by side. Checklist to qualify

For starters, note that a modest portion of equity funding helps secure the rest as debt while decreasing the debt service burden. It also serves to gain a true partner that will be on hand for subsequent rounds.

It also serves to gain a true partner that will be on hand for subsequent rounds.

This matters because senior lenders often expect there to be an equity partner at the table offering at least 15% “unexpended” (new) cash to take on a meaningful share of the risks. They tend to look more carefully and less forgivingly at loans for 100% loan-to-value, as they have only the interest payments as upside but significant downside in the event of default.

This hybrid structure involves a proportion as senior debt with the rest from our private family office (called CAP funding), which also lowers the risk for the lender, and in cases when the lender is also offering a partial “completion assurance” guarantee, increases their upside. It is unusual and highly advantageous to both increase returns and lower risk. Most of the time there is only an increase in returns when the risk is also higher, also called “risk-adjusted returns.” Instead, Programs 3 and 4 take advantage of the synergies of providing a complete capital stack for deals that qualify.

For example, if the total funding required was split 50/50, half loan, half equity, the capital stack would look like the figure shown on the right. This example uses $100 million total budget, a combination of $50M each, which could be any sector and country where we work.

With $50M as debt, for example, the project would generate the reliable returns of debt service for the lender, whether interest-only or principal plus interest. The remaining $50M via CAP’s family office would combine mezzanine debt and an equity carried interest, in this scenario, potentially leaving ~10-15% of the cashflows for the family office and a lesser amount (or for a limited period of time, or up to a capped amount) an equity kicker to the asset owner that brings the completion assurance guarantee. This preserves owner equity while balancing risks for the funders.

Larger projects may combine multiple guarantees, sharing risks and rewards proportionately.

How it works

- Developers prepare the project or portfolio’s funding package (hereinafter, the “Project”) to de-risk to the extent possible. Show your track record with similar projects in similar markets, and demonstrate close to zero commercial risk, low market risk, nominal technology risk, performance risk, political risk, etc. Although CAP funding’s family office can accept more of these risks (just not the majority of completion risk), lenders and guarantors are less likely to. In some cases, insurance wraps can help.

- We conduct initial review of the Project materials and interview the lead developer to assess chances of securing funding, as well as potential for attracting one or more guarantors. To save time, email us the draft guarantee that a commercial bank is authorizing on your own, or via a sponsor.

- If we agree on fees, timing and fundraising strategy, enter In3 engagement letter for vetting and advisory services as follows:

- Program 3: No additional cost if you bring forward a draft of the qualifying guarantee, “Do It Yourself,” or DIY. The only costs ahead of closing are associated with the debt component.

- Program 4: In3 is asked to “Do For You” (DFY) the qualifying guarantee for the CAP funding component, which typically ranges from 15% up to 50% or more, depending on the total request for funding.

- Note that guarantor(s) can:

- Offer 30% to 70% of the requested funding, either individually or as part of a syndicate. This means putting the guarantee’s underlying asset (not necessarily cash; depends on what the bank is willing to accept as collateral) to gain a Standby Letter of Credit (SbLC), Bank Guarantee or bank-endorsed Promissory Note (avalized PN or AvPN).

- If cash is used as collateral (not required), it can earn interest against a basket of U.S. Treasuries or an interest-bearing account.

- Guarantor delivers the SbLC or AvPN through the authorizing bank for either a cash fee or an equity interest (to be negotiated) in the Project, noting the anticipated returns as project IRR.

- With this structure, if a senior lender also brings the partial guarantee, lenders reduced their risk (often improving terms and time to closing) while improving cash returns and improve owner cash flows compared to CAP funding by itself. Why?

- Developer/owner is leveraging more senior debt, which is non-dilutive of owner equity

- There will be enhanced contractual rights for the lender/guarantor and CAP’s family office to cure any potential defaults, and the lender has the incentive to cure because they are the party taking the market risk whereas the guarantor only bears the risk of construction completion.

- Even in the case of a default, not only will the guarantor have earned interest in the meantime, but the guarantor will be entitled to a percentage of any sale of the distressed assets due to their equity position. With such “step-in rights,” even if the assets were to sell at 50% on the dollar, the guarantor would still likely earn far more than they would have expected to earn under their standard loan program.

- Therefore, when all goes as planned, lender/guarantor earns ~4x your original expected returns, while in the worst-case scenario, you will earn equal to or more-or-less than expected depending on how the breach is resolved, while at the same time greatly reducing your overall risk profile. In practice, the guarantee will not be called, but instead the underlying issue will be resolved during the cure period; In3’s partners have never called an instrument and really do not want to.

- Depending on how you arrange loans (existing assets from a single source, syndication, etc.), this structure could be used to enhance the lender’s or guarantor’s total portfolio by contributing a small percentage of money from each loan into the escrow account making your total portfolio of loans safer and more capital efficient.

- In addition, we might be able to arrange an insurance wrap or bond for the guarantor to hedge their risk even further for a little less equity.

- Such financial guarantees are irrevocable and unconditional, governed by CAP’s loan agreement that defines the commercial context. Again, this type of guarantee will not be draw or cashed except in the case of deliberate fraud; it is used to filter out such fraud. Guarantees can be securitized via step-in rights to the guarantor if requested, for the unlikely event that the developer does not perform.

Ask us for CAP funded project examples and additional deal structures.