This page is for prospective guarantors to better understand how CAP funding can be used to realize substantial returns from a securitized position. This outline provides a starter kit to guide decision-making. Please read carefully.

Backing secured CAP-funded impact projects leverages available assets with minimal risk and substantial upside

We are looking for partners willing to provide a partial, short-term guarantee in exchange for substantial financial compensation (generally $1M+ per year for a 1 to 3-year commitment).

We are looking for partners willing to provide a partial, short-term guarantee in exchange for substantial financial compensation (generally $1M+ per year for a 1 to 3-year commitment).

For an encapsulation, see 1-page Overview for Guarantors.

Register your interest here

How it starts: Either the project's developer or an In3 representative will present the proposed project's total budget, guaranteed portion, funding structure, banking protocols, financial upsides, project risks and timeframes.

How it is secured: Under the terms and conditions of this arrangement, even in the unlikely event of developer default, the sponsoring guarantor is in a no-lose situation. Worst case entails owning a compensatory portion of the project's cashflows.

Upside: The more likely case is return-on-assets borrowed and pledged as completion assurance when the project funding starts (upon first draw, typically) or other risk-adjusted benefits to be negotiated.

How it works: In essence, sponsors that are satisfied with the proposed arrangement ask In3 personnel to take 3 simple actions:

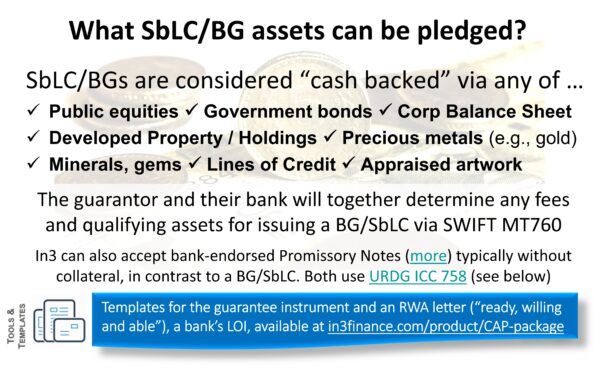

1. Draft the guarantee instrument using one of our templates

2. Propose to the issuing bank the underlying asset or balance sheet of the guarantor and gain their pre-approval -- and when one of our funding banks agrees to accept it, nothing is binding, but we have assured feasibility

3. In3 obtains a letter from the involved bank. RWA letters are widely used to signal the intent by the bank, in this case, to later follow through instrument delivery once the project's funding is under contract.

That's it! Guarantors will have the opportunity to review and approve at any of these or other checkpoints. Just as with conventional project finance, the respective parties gain consent to fulfill all proposed arrangements.

In3 offers support to developers we know as a premium service when gaining sponsors for high-quality projects. Projects must have extremely low commercial risk, rock solid business plans, above-average IRRs, top contractors with completion/performance bonding, etc., to enter an In3 Management Services Agreement for this representation.

In3 offers support to developers we know as a premium service when gaining sponsors for high-quality projects. Projects must have extremely low commercial risk, rock solid business plans, above-average IRRs, top contractors with completion/performance bonding, etc., to enter an In3 Management Services Agreement for this representation.

Most developers will prefer to facilitate their own project's guarantee to preserve equity carried interest and available cash for service fees, but CAP funding is a unique structure that must be explained properly to gain support from third party guarantors that are not involved as stakeholders. more

CAP funding guarantees offer new opportunities to leverage assets, while preserving cash capital, that deliver positive social and/or environmental impacts. Investment Strategy addresses several of the UN Sustainable Development Goals. more

Here is a self-guided tour of CAP funding's logic, advantages and protocols. We highlight how guarantees can be structured as a "no lose" proposition, and are quite safe and secure. Worst case results in the guarantor owning substantial carried interest.

Follow the links below to learn more.

Deciding which CAP funding guarantee to use

What is a "Completion Assurance" guarantee used for project finance?

An innovative structure for lenders who wish to enhance their returns at lower risk

About In3 Capital

In3 Capital Group has been in business since 1996, one of the original firms to focus on project finance for renewables and impact investing. Since that time, we have gained the trust and respect of capital partners in the US and overseas, working in markets that make a difference for people, improving lives, and the planet, aimed at solving gnarly problems like climate change.

Testimonials

“This expansion will create up to 350 additional jobs in rural Mexico. It has been a pleasure working with you and your team, and it is clear in hindsight your preparation work and responsiveness was key to gaining lender interest and approval. After the preparation, the loan due diligence went quickly, and your assistance was timely and professional. In3’s advisory, guarantee facilitation, and consulting services were greatly appreciated throughout. I am happy to recommend In3’s services to others seeking long-term project financing. Thank you!”

Rusty Brown

Rusty Brown

President

Fine Dried Foods International

Daniel at In3 Capital is brilliant, energetic, devoted and a joy to work with. He is passionate in making the world a better place through advancing the knowledge and enthusiasm for sustainable technology and practices.

I highly recommend Daniel if you want to get something done beyond your expectations.

Hina Pendle

Us Partners

Business Architecture Guild

LinkedIn