Plunging Renewable Energy Costs highlighted at “RenewFi” in California

Global Expansion Opportunities Abound

By Daniel Robin

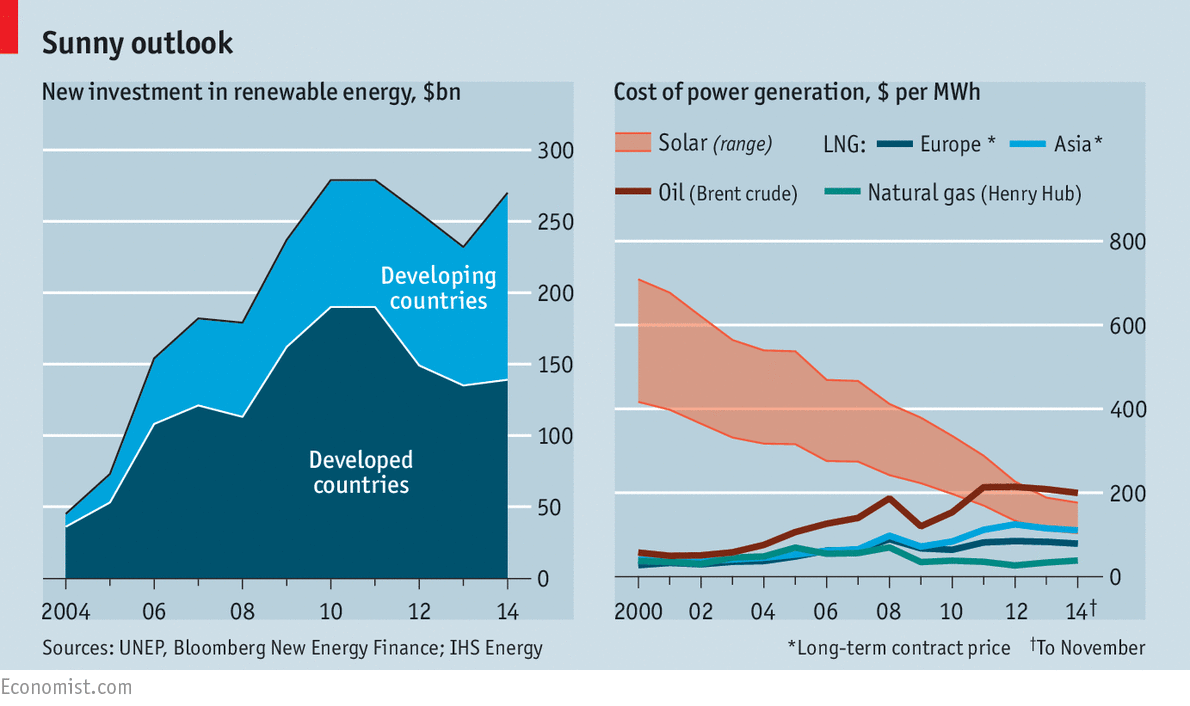

Recent article in the Economist shows 2014 total investment in renewable energy, most notably in wind and solar, rose by a sixth to $270 billion globally.

Recent article in the Economist shows 2014 total investment in renewable energy, most notably in wind and solar, rose by a sixth to $270 billion globally.  Further, changes in the Electricity Market in Mexico, juxtaposed already strong opportunities for greater energy security in emerging markets like the Caribbean, SE Asia and sub-Saharan Africa, explain why attendees found the value they were looking for in the recent Bay Area Renewable Energy Finance conferences, or “RenewFi,” held earlier this year (see related article). Investors today simply get more energy “bang” for their buck.

Further, changes in the Electricity Market in Mexico, juxtaposed already strong opportunities for greater energy security in emerging markets like the Caribbean, SE Asia and sub-Saharan Africa, explain why attendees found the value they were looking for in the recent Bay Area Renewable Energy Finance conferences, or “RenewFi,” held earlier this year (see related article). Investors today simply get more energy “bang” for their buck.

The cost of storage, for example, a vital part of a solar-powered future, has fallen by 60% since 2005, and the overall cost of a solar-power system is down by 75% since 2000. IHS, a consultancy, reckons the cumulative fall will be 90% by 2025.

New investments in renewable energy greatly increased in 2014, with projects in developing countries now roughly equal to investments in the US and other developed economies. This was partly because of subsidies such as the US 30% federal tax credit (FTC) for solar projects, but even if that tax credit is cut, solar electricity, wind and waste conversion will continue to displace other, dirtier sources of energy.

Despite partisan politics, there’s wide-spread agreement about the increasing importance of renewable energy: when asked about new energy sources in recent surveys, Americans see solar and wind as where the new capacity must come from. See full report here.

The days when renewables were just a hedge on volatile oil prices, or to alleviate “green guilt” (to ease rich-world consumers’ consciences) are clearly over. Oil and coal are being gradually replaced by those with less risk, health problems and environmental downside. The demand for cleaner and greener energy and related renewable resources are also showing up in the real estate markets.

These and other themes will be featured at the upcoming Renewable Energy Finance (RenewFi.com) taking place in late April in San Jose, CA. The first RenewFi featured diverse private equity, family office, impact and institutional venture capital focused on diverse markets and renewables-related solutions, emphasizing mid-sized projects using non-traditional sources of funding. More at www.renewfi.com/program

Pre-registration discounts and sponsorship opportunities available until 20 April 2015. Mention that you saw this article and receive a special VIP discount on registration.